Top 10 Reasons Why I Use [THIS] Comp Crushing Real Estate Software

My Roadies,

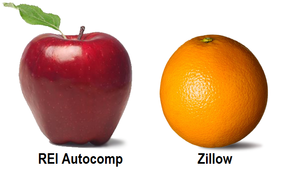

I get asked often how I was able to scale up my business and outsource each position to others so I can build other companies as an entrepreneur. Well this is just one of those steps. Analyzing properties is a time consuming task and you'll grow exhausted of looking at bad deal after bad deal. You'll get frustrated when you don't have the data you need to make a decision on a "hot lead". You'll go crossed eyed looking at the jumbled mess of information that is not relevant or pertinent to the ARV and the enter/exit strategy on each deal. That my friends is why I created REI Autocomp. Website: http://www.reiautocomp.com Don't forget T'FLOSS. TAG FOLLOW LIKE OPT-IN SHARE SUBSCRIBE: https://www.youtube.com/user/TheREIRockstarTV?sub_confirmation=1 Then leave a comment about how you need this tool or how we can make it better!!! Thanks for watching. Rock on, Randy - The REI Rockstar http://www.TheREIRockstar.com Let's Connect: FACEBOOK - https://www.facebook.com/thereirockstar YOUTUBE - https://www.youtube.com/user/TheREIRockstarTV TWITTER - https://twitter.com/The_REIRockstar INSTAGRAM - https://www.instagram.com/thereirockstar GOOGLE + - https://plus.google.com/+TheREIRockstar Video Tags: analysis, arv, after repair value,price per square foot, calculate, spredsheet, comps, comparables, template, value, values, worth, whats my home worth, real estate investing, flip houses, how to, real estate investing for beginners, real estate 101 REI Autocomp Vs. Zillow... It's Apples And Oranges. We often get questions about our software as to the accuracy of the data or how our software compares to a so-called competitor (there are none really). Well we decided to look at some similarities and differences in the Zestimate and our CompScore provided by Zillow and our service REI Autocomp. Zillow is a a real estate life cycle website that has a feature called a Zestimate. This estimate is a proprietary algorithm of theirs and as is ours. So although we can not tell you how they officially calculate the property value for either company, please understand that the accuracy of any evaluation is in the root data. We can express that at their own admission because the number they generate can vary in accuracy from market to market. What we mean is that the more "data points" or in this case "sold properties" you may have when analyzing a property, the better the opportunity for accuracy. (Note: We do no sell "sold data" as that is against the TOS of our providers, we do however sell the use of our software's algorithm, charts and instant offer features, etc.) To further the comparison check out the chart we referenced from their website: Reference: http://www.zillow.com/zestimate/#acc Statement: WITHIN 5% OF SALE PRICE: This is the percentage of transactions in a location for which the Zestimate was within 5% of the transaction price. Nationwide, Zestimates are currently within 5% of the final sale price 38.4% of the time. So what the above facts mean is that the Zillow Zestimate is only within 5% of the eventual sales price 38% of the time. So on a property that perhaps sold for $360,000 their Zestimate could be as low as $342k or as high as $378k. So this mean that 62% of the time the gap is LARGER. This was unacceptable for us as investors or frankly and as homeowners. So we decided to take on the task of creating my own evaluation software with a greater accuracy then Zillow. Brave we know. Here are some sources of where one can find data points for use in preparing a property evaluation: Title Data MLS Data Appraisal Data County Data Our software utilizes data from four sources currently, one of which is the Zillow API "sold data". Another "difference" from other online evaluations is that we not only provide the current market value but also the distressed market value (what a home like the subject property sells for in distress) and the after repair value (what a home like the subject property sells for in excellent condition). Finally we allow our users/members to create their own custom offers once they dial in the values. This allows them to create offers in seconds, not hours. I hope this explanation was detailed enough for you and you are welcome to download a trial version today. Website: http://www.reiautocomp.com Best regards, Randy - Creator of REI Autocomp [FIVE] Painful Reasons Why You Should Join Over 1000+ Users Of REI Autocomp Investment Analysis Software Let me be Frank. Running comps on thousands of leads only to buy a few of them SUCKS! That is if you can get ACCURATE COMPS in the first place. Right now investors BIG and SMALL have to first get a good data source to make the right decisions on properties and some are not FREE. The free sources are OK but the formula they use to calculate those values are terrible. I mean would you compare a: "1 Bed/1 Bath Condo" to another "2 Story 5 Bed/3.5 Bath" a mile away? No! Below are five road blocks and down right migraine headache culprits investors face when trying to analyze an investment property the right way. Some sources have barriers that require a license. Eh hem.. (THE MLS) Reason #1: MLS Access Even if you have a Realtor in your back pocket, they'll wait fourteen days to get back to you and then send you a GARBLED mess of spreadsheets and screenshots (which have new "LISTINGS" not SOLD houses!) And... AND! That's just the data... Yup you now have to sift through and find out which property is like your subject property. You told the home owner you can make an offer 14 days ago!!! Its no wonder a new investor can't get a break and flip their first deal. It is also why tenured investors lose so much money on profit from (direct mail, online adwords and bandit sign) marketing that goes right down the drain. #2 Full On Appraisal It goes without saying that it would be unwise to spend a few hundred dollars on an accurate evaluation for each and every home you are considering to buy. That cost can add up quickly and you may not even close the deal. #3 Free Websites A comparable is a comparable, so your second best way to get the data you need is to get comparable sales data from some of the FREE websites out there. The problem is each website only covers 25-75% of the actual sold homes. So you need to visit several to get an accurate picture of what sales have occurred in the area. #4 Time Is Money Have you ever heard of analysis paralysis. This is what happens when you brain is fried after crunching numbers on a home or two. Lines begin to blur, doubt sets in and you talk yourself out of a deal. Some tenured investors have it down pat but I personally know investors who buy a couple of lemons a year. Literally "overpay" for properties at the courthouse steps or from the MLS REO market. Its sad. Just plain sad. #5 Consistency Ever ran numbers on a deal and just felt that this one is a "winner". We are human though and we're prone to make mistakes. Every deal is different and trying one technique, enter or exit strategy on one deal vs another, is like trying to fit a square peg through a round hole. Don't you just wish there was a SOLUTION to all of these investor woes? Well, THERE IS! Yes, my fellow investors this is exactly why I sat down and created a solution I called REI Autocomp. Over 1000+ investor (users) across the US agree with me. Getting your analysis done on any property in the US (Well 38 states) in under 30 seconds without access to the MLS is awesome! REI Autocomp helps our team make offers quickly and easily without have to chase down Realtors. And if you do have "comp data" you can upload it right into the REI Autocomp system so IT DOES ALL THE HEAVY LIFTING AND SIFTING! We are excited to announce that the pricing of our signature product is now even more affordable. Website: http://www.reiautocomp.com/pricing.html 7 Day Trial - FREE! Monthly - $14.97 Quarterly - $29.97 Annually - $79.97 Lifetime - $297.00 So got get your copy today and start flipping more deals. Rock on, Randy - Creator of REI Autocomp P.S - I AM THE FIRST. I created this tool in 2010. Some people out there (both large and small) have tried and will continue to try and create something like this because they were not sharp enough to create this themselves or give credit where credit is do. That is if they are brave enough to think up the 99 point scoring system with over 1000 variables and a random deduction generation algorithms to ensure it can not be reverse engineered. Attempts at this have ended up being just numbers on a page like every other tool out there. These folks are cronies and losers. You know what they say, "Imitation is the best form of flattery." So that's OK, because I welcome competition. I take on the Tiger Woods approach. I have no competition other than myself. Here's to capitalism! |

Real Estate Software Analysis BlogREI AutocompHere you'll find out even more information about our software including Tutorials, Updates and New Releases. Archives

May 2020

Categories

All

|

RSS Feed

RSS Feed